Depreciation expense formula

Sep 14 2021 4 min read. Reduce Your Income Taxes - Request Your Free Quote - Call Today.

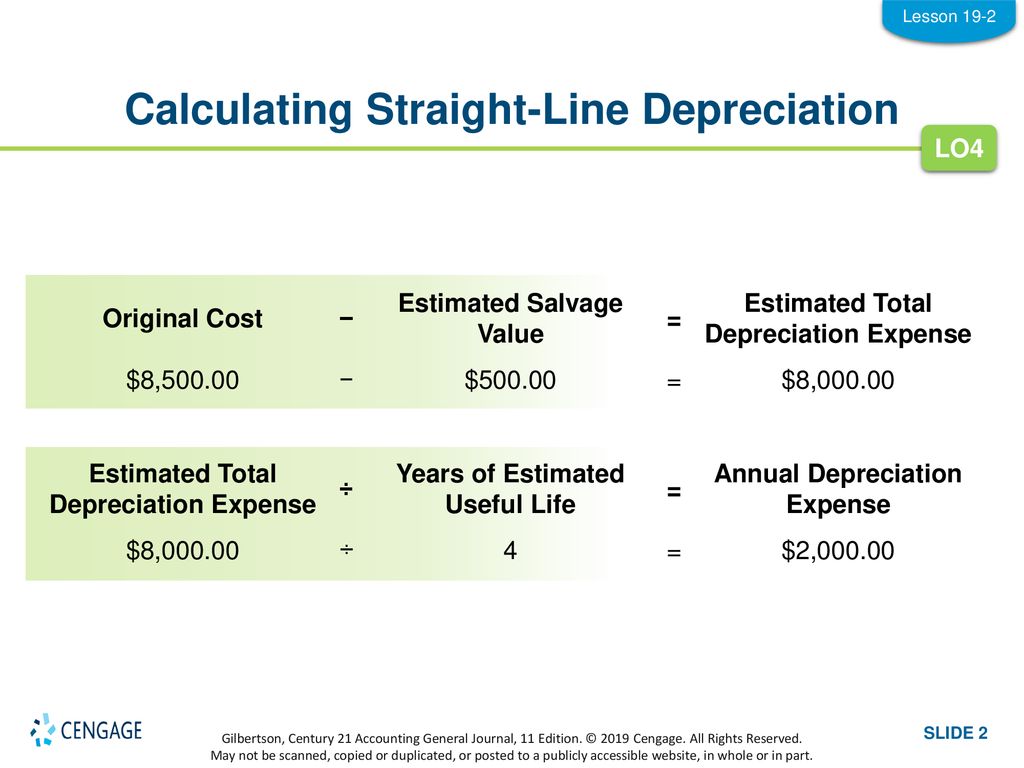

Lesson 19 2 Calculating Depreciation Expense Ppt Download

Reduce Your Income Taxes - Request Your Free Quote - Call Today.

. If the machines life expectancy is 20 years and its salvage value is 15000 in the straight-line depreciation method the depreciation expense is 4750 110000 15000. Fixed assets lose value over time. The formula is as followed.

The numerator of the fraction is the current years net. You buy a car for 50000. 100000 20000.

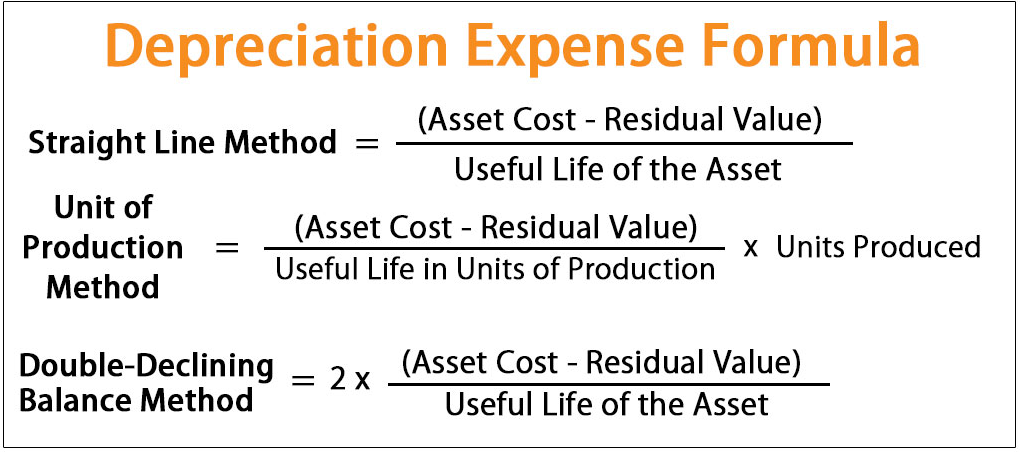

DDB Net Book Value - Salvage Value x 2 Useful Life x Depreciation Rate. How to Calculate Depreciation Expense. Depreciation Cost of asset Residual Value x Annuity factor.

Under the income forecast method each years depreciation deduction is equal to the cost of the property multiplied by a fraction. Ad Get A Free No Obligation Cost Segregation Analysis Today. Under this method we transfer the amount of depreciation every.

The straight-line method of depreciation allocates its cost over its useful life. The intent of this. For example an asset with a useful life of five years would have a reciprocal value of 15 or.

The straight line depreciation for the machine would be calculated as follows. This method uses the following formula. Depreciation Expense Beginning Book Value for Year 2 Useful Life.

Depreciation Expense Total PP. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Depreciation represents the allocation of the one-time capital. Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. Ad Get A Free No Obligation Cost Segregation Analysis Today.

Sinking fund or Depreciation fund Method. Depreciation Expense Number of Units Produced Life in Number of Units x Cost - Salvage Looking at our 10000 asset lets assume that it can produce 500000 units. For example the first-year.

This amount is then charged to expense. The formula is as followed. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Depreciation expense is that portion of a fixed asset that has been considered consumed in the current period. Depreciation Formula Calculate Depreciation Expense The. 100000 Cost of the asset Estimated salvage value.

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. Cost of the asset. The units-of-production depreciation method calculates the depreciation expense per unit or product.

Lets use a car for an example.

Unit Of Production Depreciation Method Formula Examples

How To Calculate Depreciation Expense

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Expense Double Entry Bookkeeping

Accumulated Depreciation Definition Formula Calculation

Depreciation Expense Calculator Hot Sale 57 Off Www Ingeniovirtual Com

Depreciation Expense Calculator Hot Sale 57 Off Www Ingeniovirtual Com

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense