51+ what do banks look at when applying for a mortgage

Web Check your credit score at least several months before you apply for a mortgage and work on improving it. Web 19 hours agoA simple way to demonstrate how comparing APRs doesnt tell you the whole story is by looking at the monthly cost of fixed upfront fees.

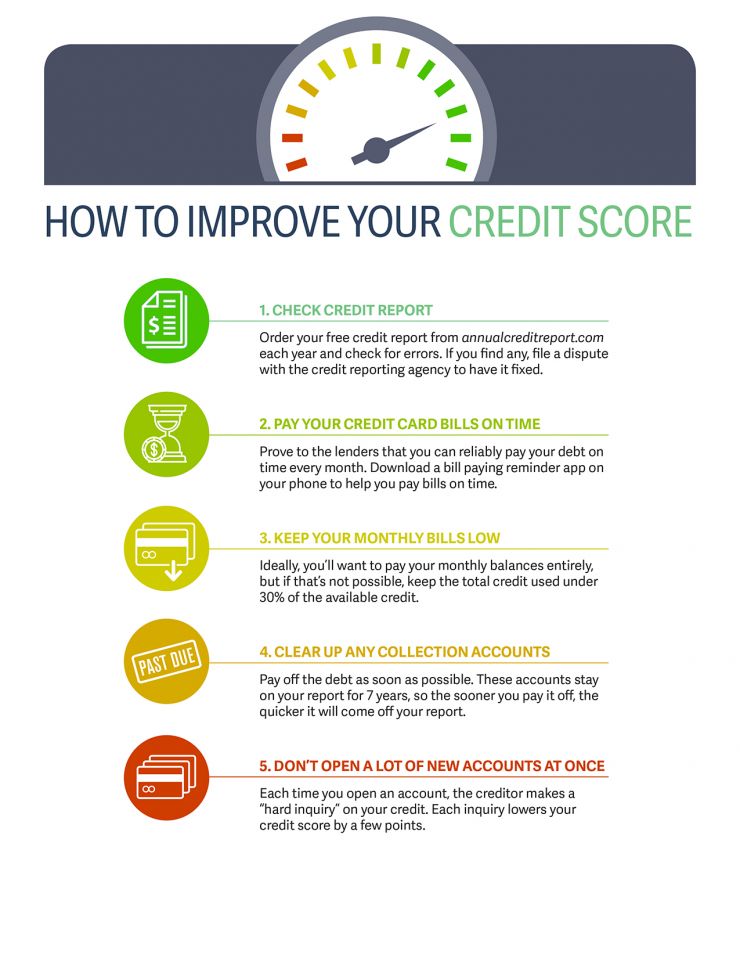

How To Improve Your Credit Score Sun Federal Credit Union

Web Theyll likely check any and all of your bank accounts during this process.

. Fill out a mortgage application. Web How to Be Successful. You should also have at least 20 of your homes value as a down payment.

Complete bank statements for all financial accounts including investments for the last 2 months. Web The Consumer Finance Protection Bureau CFPB recommends that you contact at least three lenders on your shortlist. All these things will ensure that youre capable of taking out a.

Your Income and Assets The most obvious aspect lenders look at when reviewing tax returns. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Apply Online To Enjoy A Service.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Serious About Finding Your Next Home. Web What Documents Do I Need To Present To The Bank To Apply For A Mortgage As A First.

Web When you apply for a mortgage lenders will generally request all three of your credit reports one from each credit bureau and a FICO Score based on each report. Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes. Web Here are the things most mortgage lenders look for on your tax returns.

Experts continue to encourage buyers to save a down payment of at least 20 before applying for a mortgage. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Web 6 steps to applying for a mortgage. Ad PNC Offers A Wide Range of Mortgage Options. A proof of deposit.

Finally your lender uses your bank statements to see whether you have enough money. Choose a lender and commit. Paying off credit card balances making sure you.

Youll pay more without a minimum 20 down payment. Ad Compare Best Mortgage Lenders 2023. As you get closer to the higher end of that.

Also high volume can alter turn times. While they look at your credit score they also dive. Web Banks and credit unions tend to take a bit longer than mortgage companies.

Ad Highest Satisfaction for Mortgage Origination. Apply Online To Enjoy A Service. Web If youre applying for a conventional loan through Fannie Mae or Freddie Mac you can have a DTI as high as 50.

Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes. 5 Factors That Banks Look For During Your Loan Application When you buy a home you may only be able to pay for part of the purchase.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Mortgage lenders will see you as an even safer loan candidate if they know you have assets that can be converted into cash quickly in the event of a. It may take more than 60 days to close a.

Web Financial institutions will closely scrutinize your credit report when reviewing your application for a mortgage loan. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. Web The scoring model used in mortgage applications While the FICO 8 model is the most widely used scoring model for general lending decisions banks use the.

Web Before completing an application youll want to ensure you have these 6 things. Review your Loan Estimates. Set A Budget Know What You Can Afford.

Apply Online Get Pre-Approved Today. Web A few things that lenders consider are detailed bank statements credit debts income and employment history. Start The Application Process Today.

For example if you take out a. Ad Highest Satisfaction for Mortgage Origination. Almost all areas of your personal finances will be under scrutiny.

There is no formula that tells you the. Web The lender needs to verify that the funds required for the home purchase have been accumulated in a bank account and accessible to the lender. Web Bank statements are just one of many factors lenders look at when you apply for a mortgage.

Most lenders look for information about your income employment.

Bh Let That Shit Go 9 Color Eyeshadow Palette Revolution Beauty

Rozbolms Vhlvm

Bank U Turn On Mortgages For Borrowers With Small Deposits

2021 Amerant Esg Report Imagine A Bank That Cares By Amerantbank Issuu

Analysis Of Repayment Behavior Of The Retail Loan Borrowers Of Brac Bank Ltd By Md Papon Issuu

Brac Bank Payment Retail Loan By Md Papon Issuu

Top Business Loans In Chandrapur ब ज न स ल न स च द रप र Loan For Business Justdial

What Do Mortgage Lenders Look For When Approving A Home Loan

L0uxuoddlqmjhm

How A Mortgage Broker Can Help When Buying Business Property

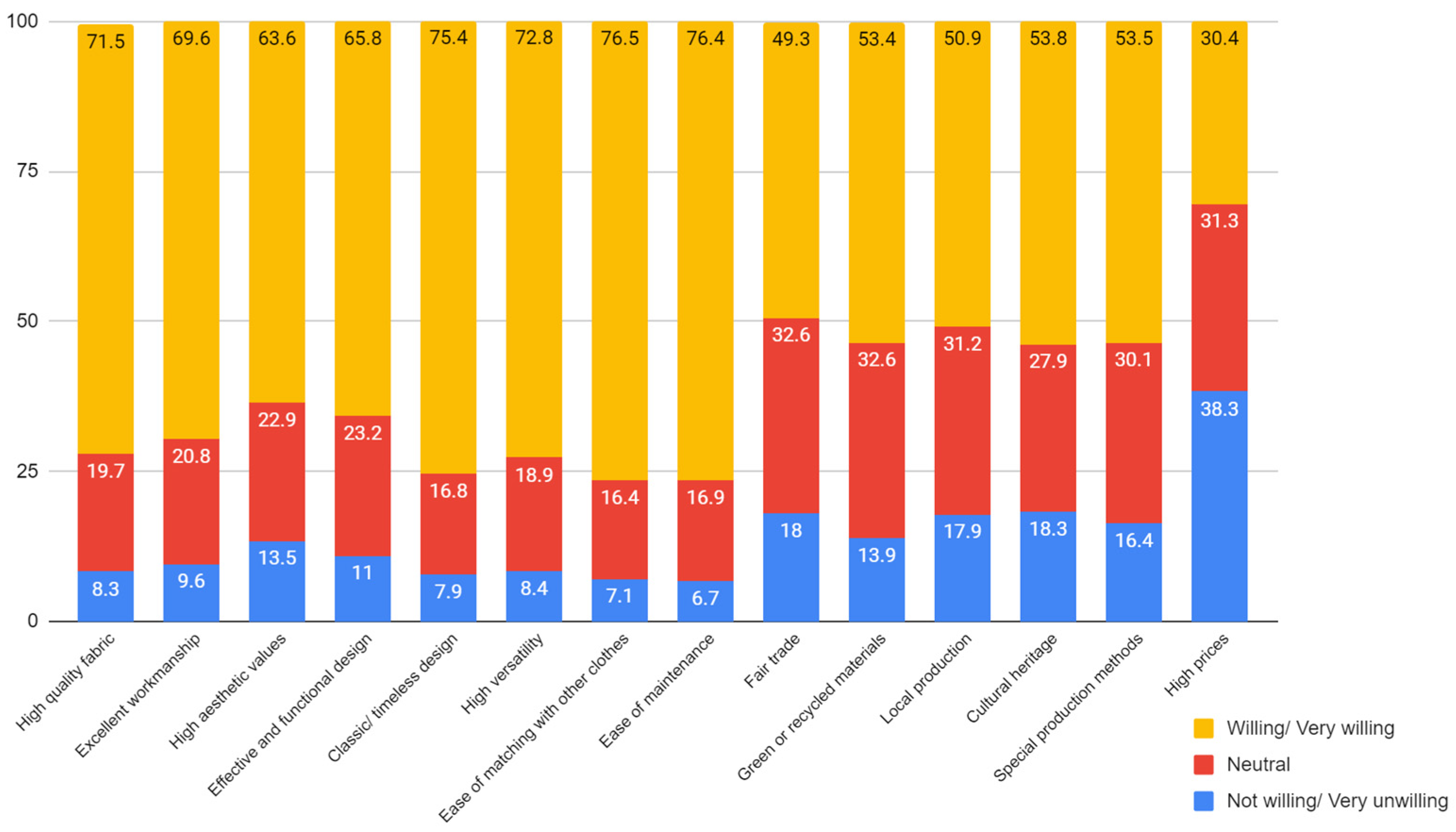

Sustainability Free Full Text Slow Fashion Is Positively Linked To Consumers Rsquo Well Being Evidence From An Online Questionnaire Study In China

Asian Legal Business Seasia Jun 2010 By Key Media Issuu

What Do Mortgage Lenders Look For On Bank Statements Guild Mortgage

Being Your Own Bank Unraveled By Wealthy Without Wall Street Issuu

51 Free Editable Loan Application Letter Templates In Ms Word Doc Page 4 Pdffiller

Efg Eurobank Ergasias S A Corporate Social Eurocharity

51 Se Harbor Point Dr Stuart Fl 34996 Realtor Com